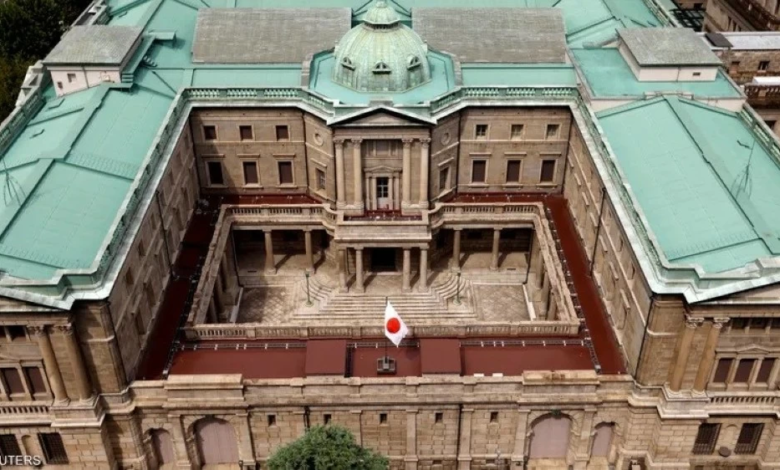

Bank of Japan Governor sets interest rate path and future monetary policy course

Bank of Japan Governor Kazuo Ueda affirmed that the bank will adopt a cautious approach, relying entirely on incoming economic data to determine the future path of interest rates. He noted that the country's financial conditions remain favorable and supportive of economic activity. These remarks indicate that the bank is not in a hurry to tighten monetary policy rapidly without ensuring the stability of economic fundamentals.

In his press conference following the bank meeting, Ueda outlined the bank's future strategy, stating, "We will continue to raise interest rates if our economic forecasts and price outlook are met, but the pace and path will depend on developments at that time." He added, according to international news agencies, that the bank needs sufficient time to assess the impact of previous rate hikes on markets, businesses, and households, emphasizing, "We will carefully examine the available data at monetary policy meetings and update our outlook on economic developments, price expectations, risks, and the likelihood of achieving our forecasts.".

Context of the historical shift in Japanese monetary policy

These statements are particularly significant given the historical context of the Japanese economy, as Japan seeks to finally emerge from decades of deflation and the implementation of negative interest rate policies that lasted for many years. The central bank is currently attempting to gradually normalize monetary policy to ensure it does not stifle fragile economic growth, focusing on achieving a "virtuous cycle" between rising wages and rising prices—a long-sought goal for Tokyo policymakers in their quest to achieve a stable inflation rate of 2%.

Expected impacts locally and globally

Domestically, analysts are closely monitoring the impact of any future interest rate hikes on borrowing costs for Japanese companies and on mortgage lending for individuals, which could affect consumption levels. Internationally, the Bank of Japan's decisions are closely watched by global markets due to their direct impact on the value of the Japanese yen. A narrowing of the interest rate differential between Japan and major economies (such as the United States) typically supports the value of the yen, which can, in turn, affect the profits of large, export-oriented Japanese companies, as well as global capital flows that have relied for years on the yen as a cheap funding currency.

In conclusion, Oeda’s statements indicate that the central bank will remain on high alert, balancing the risks of inflation with the need to support economic recovery, making the bank’s upcoming meetings a focus for investors around the world.