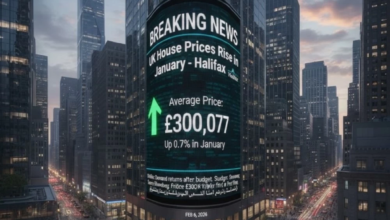

Venezuela's stock market jumps 130% after Maduro's arrest: Has the recovery begun?

The Venezuelan experienced an unprecedented surge, reaching a record high fueled by widespread optimism among both international and domestic investors. This sharp price movement followed the dramatic political developments in the country, namely the arrest of President Nicolás Maduro by US forces on January 3rd, an event considered by markets to be a pivotal turning point in the country's economic history.

According to data published by CNBC and reviewed by Al Arabiya Business, the Venezuelan stock market's main index, the IBC, has surged by more than 130% since the US intervention. This dramatic rise reflects the financial markets' bet on the end of an era of economic isolation and the beginning of a new phase that may be characterized by openness and restructuring.

Bets on saving the struggling economy

Economic analysts believe this surge reflects a preemptive assessment by investors of the potential for stability in the Venezuelan economy, which has suffered for years from mismanagement, crippling international sanctions, and sovereign debt default. Expectations are growing that the formation of a new government could pave the way for an influx of foreign capital, a revitalization of the vital oil sector, and, most importantly, the normalization of diplomatic and trade relations with the United States, thus leading to the lifting of sanctions.

Historical context: From collapse to hope

To understand the extent of this optimism, one must consider the historical background of the Venezuelan economy. Venezuela possesses the world's largest proven oil reserves, yet its production has plummeted over the past decade due to underinvestment, mismanagement, and sanctions. This has led to a sharp contraction in GDP and hyperinflation that has impoverished a large segment of the population. Therefore, the current political shift is seen as a golden opportunity to reintegrate Venezuela into the global economy and restore its role as a major energy exporter, which would have positive effects not only domestically but also on the stability of regional and international energy markets.

Unequal gains and high-risk opportunities

Commenting on these developments, Anthony Symonds, investment director at a British wealth management and investment firm, said: “Investors have begun to price in Maduro’s removal from power as a prerequisite for easing sanctions and, ultimately, reaching an agreement to restructure the accumulated debt.”.

Simond explained the nature of the current financial flows, saying: “The demand is coming from a wide range of investors, including major emerging market asset managers, as well as hedge funds and distressed debt specialists seeking to make asymmetric gains, taking advantage of the opportunities that are on the horizon.”.

Liquidity challenges and volatility

Despite this positive outlook, strategists warn that the road ahead remains fraught with risks. The Venezuelan stock exchange is still a small and illiquid market, making it difficult for global investors to easily enter and exit. This market nature means that price fluctuations can be sharp and volatile in both directions. Notably, the Venezuelan IBC index recorded a phenomenal increase of 1644% during 2025, underscoring the speculative and high-risk nature of this market under current conditions.