China continues gold purchases for the 15th consecutive month, supporting global markets

The People's Bank of China continued its policy of bolstering its gold reserves, extending its purchases for the fifteenth consecutive month. This move reflects the continued strength of official demand from the world's second-largest economy, at a time when global gold markets have experienced sharp fluctuations, with the record-breaking rally in bullion prices facing heavy selling and profit-taking in global markets late last month.

Purchase details and official data

Official data released on Saturday showed that the People's Bank of China's (PBOC), the central bank, increased its gold bullion holdings by approximately 40,000 troy ounces last month. This increase is part of the bank's latest strategic gold purchase program, which began in November 2024, underscoring Beijing's long-standing commitment to diversifying its reserve assets.

Strategic motives: Why is China so insistent on gold?

China's actions cannot be understood in isolation from the global economic and geopolitical context. Gold has historically been a preferred safe haven for countries during periods of uncertainty. Like many central banks in emerging economies, the People's Bank of China (PBOC) seeks to reduce its excessive reliance on foreign currencies, particularly the US dollar, within its foreign exchange reserves. This strategic approach aims to protect the national economy against potential sanctions or sharp fluctuations in exchange markets, as well as to hedge against global inflation rates that could erode the purchasing power of currencies.

Market dynamics: between speculation and official demand

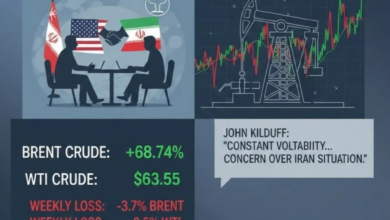

During January, waves of speculative interest propelled gold and silver prices to consecutive record highs, fueled by interest rate expectations and geopolitical tensions. However, markets experienced a sharp decline towards the end of the month due to corrective selling. Since then, prices have recovered some of their losses, but a wait-and-see approach still prevails as investors reassess their positions following the downturn. This highlights the crucial role of central banks as a price floor; their continued official demand helps absorb excess demand and prevent a dramatic price collapse.

A global look at central bank trends

China was not alone in this trend; purchases by global central banks, a key driver of the gold market, surged in the final quarter of 2025. According to data from the World Gold Council, total annual purchases exceeded 860 tons. While this level falls short of the 1,000 tons acquired annually over the previous three years, demand is expected to remain at historically high levels, reinforcing gold's status as an indispensable strategic asset within national reserves.