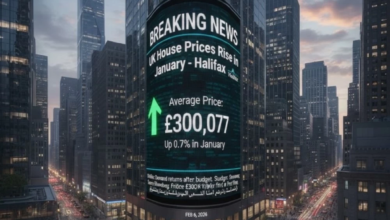

Dow Jones surpasses 50,000 points for the first time, boosted by technology

US financial markets recorded an unprecedented historical achievement during trading on Friday, as stocks boosted their gains, with the Dow Jones Industrial Average breaking through an important psychological and technical barrier, driven by a return of investors' appetite for risk and their heavy interest in technology and artificial intelligence companies.

In trading details, the Dow Jones Industrial Average jumped 2.24%, adding 1,093 points to close at 50,001. This marks the first time in the index's long history that it has surpassed the 50,000-point mark, reflecting strong buying momentum and market optimism about the resilience of the US economy and the ability of major companies to continue growing.

The gains weren't limited to the Dow Jones; other major indices also rose. The broader S&P 500 climbed 1.72%, adding 117 points to close at 6,915, recovering from earlier losses and returning to year-to-date gains of over 1%. The tech-heavy Nasdaq Composite also rose, gaining 1.91%, or 430 points, to reach 22,971, although it still recorded a weekly decline of about 2%.

This strong rebound in the technology sector came as a positive reaction after a period of sluggishness and volatility that lasted for days, stemming from investor concerns and their assessment of the impact of the rapid development of artificial intelligence on the profitability of the traditional software industry. Nvidia shares led the rally with a 7.32% jump to $184.47, followed by Broadcom shares, which rose 7.14% to $332.69, in addition to gains in Oracle (3.59%) and Palantir (4.32%).

The historical and economic significance of the event

The Dow Jones Industrial Average surpassing 50,000 points carries profound economic implications that extend far beyond mere numerical significance. Historically, the Dow Jones is one of the oldest benchmarks for US stock market performance, and breaking through major centennial and millennium barriers has often provided a tremendous morale boost for investors worldwide. This new level reflects a fundamental shift in the structure of the US economy, with technology and semiconductor companies now playing the primary role of growth drivers, replacing the traditional industrial companies that dominated the index in previous decades.

Expected impact locally and globally

Internationally, this achievement is expected to have a positive impact on global markets as trading opens next week, with Wall Street often setting the tone for trading on European and Asian exchanges. The renewed confidence in the artificial intelligence sector also sends reassuring signals to investors that the feared "tech bubble" is not about to burst, and that the sector still possesses genuine growth potential.

Regionally, the financial markets in the Middle East and the Arabian Gulf region may benefit from this momentum, given the close link between global markets and capital flows, in addition to the fact that increased risk appetite globally often has a positive impact on foreign investment flows towards emerging markets and the region's markets.