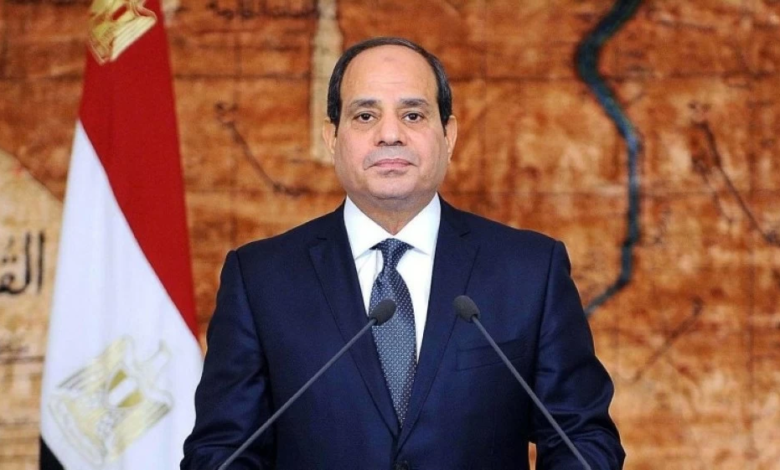

Sisi directs efforts to reduce public debt indicators and boost foreign reserves

Egyptian President Abdel Fattah al-Sisi directed the government and the central bank to intensify joint efforts to reduce and improve the debt indicators of the public budget, and to work diligently to reduce the debt service burden, in a move aimed at strengthening the resilience of the Egyptian economy in the face of global challenges.

High-level meeting to formulate financial policies

This came during a meeting held by President El-Sisi on Sunday with Prime Minister Mostafa Madbouly, Central Bank Governor Hassan Abdullah, and Finance Minister Ahmed Kouchouk. The meeting included a comprehensive review of financial and economic indicators, with the President emphasizing the importance of accelerating the path to fiscal sustainability and strengthening fiscal discipline.

The presidential directives stressed the need to improve the debt structure, which is a fundamental pillar to ensure that state resources are directed towards vital service sectors and support human development efforts that directly affect the lives of citizens, instead of draining resources on paying debt interest.

Strengthening foreign reserves and monetary stability

In a related context, the Egyptian president directed officials to focus on increasing foreign currency reserves and meeting the necessary financing needs to bolster development efforts. This directive reflects the state's commitment to ensuring the availability of essential goods and production inputs in the local market, thereby contributing to job creation and supporting the business environment.

According to a statement from the Presidency, the meeting addressed mechanisms for strengthening financial and monetary stability. Coordination between fiscal policy (government) and monetary policy (central bank) is considered the cornerstone at this stage to ensure the continued downward trend in inflation rates, especially after the positive indicators that showed a decline in inflation during November 2025 on both a monthly and annual basis.

The importance of debt reduction in the economic context

These directives are of paramount importance in the current economic context, as Egypt seeks to balance fiscal discipline with growth. Reducing the debt-to-GDP ratio and achieving the targeted primary surplus are not merely financial figures; they are indicators of confidence for both domestic and international investors and enhance the country's credit rating.

Controlling public debt also gives the state greater fiscal space to spend on health, education, and infrastructure, which positively impacts the quality of services provided to citizens. Experts emphasize that the government's continued achievement of primary budget surpluses, coupled with the central bank's price control policies, represents the safest path to overcoming economic pressures and achieving sustainable and inclusive development.