Oil prices fell as the world awaited US-Iran talks in Oman

Global oil prices relinquished all earlier gains, turning sharply lower during trading on Friday, as caution and anticipation gripped investors in global energy markets. This decline coincides with markets awaiting the outcome of the anticipated nuclear talks between the United States and Iran, scheduled to be held in Oman, which are seen as crucial in defusing geopolitical tensions in the Middle East.

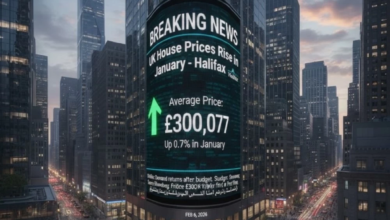

Market performance and benchmark figures

In trading details, Brent crude futures for April delivery fell by about 0.10%, or 7 cents, to settle at $67.48 a barrel, after reaching $68.82 earlier in the session. Meanwhile, West Texas Intermediate (WTI) crude futures for March delivery declined by 0.15%, or 13 cents, to $63.16 a barrel, retreating from their session high of $64.58.

Weekly data indicates that both crude oils are heading towards their first weekly loss since the beginning of this year, with Brent crude heading towards weekly losses of up to 4.6%, while US crude is close to recording a weekly decline of about 3.2%, affected by a broad sell-off that affected various investment assets this week.

The geopolitical context and the importance of the Oman talks

The talks in Muscat are of major strategic importance to energy markets, as Oman has historically played the role of a trusted mediator in contentious issues between Tehran and the West. Investors hope these diplomatic efforts will help de-escalate the rising tensions between Washington and Tehran, particularly given previous concerns about a potential US military strike against Iran by President Donald Trump—a scenario that threatened the security of energy supplies through the strategic Strait of Hormuz.

It is well known in the oil markets that military tensions in the Arabian Gulf region add a so-called "risk premium" to the price per barrel. Therefore, any news of diplomatic solutions or negotiations typically leads to the erosion of this premium, putting downward pressure on prices. This explains the current market reaction of erasing gains as soon as talk of dialogue begins.

Economic indicators and supply factors

On the economic front, the decline in oil prices contrasted with the movement of the US dollar, as the dollar index – which measures the greenback against a basket of six major currencies – fell by 0.25% to 97.60 points. A weaker dollar typically supports prices of commodities priced in dollars, such as oil, but geopolitical factors had a stronger impact in this session.

On the supply side, markets are awaiting the release later today of Baker Hughes’ weekly report on the number of active oil and gas drilling rigs in the United States, which is a preliminary indicator of future US production levels and may add further clarity on the balance of supply and demand in the global market.