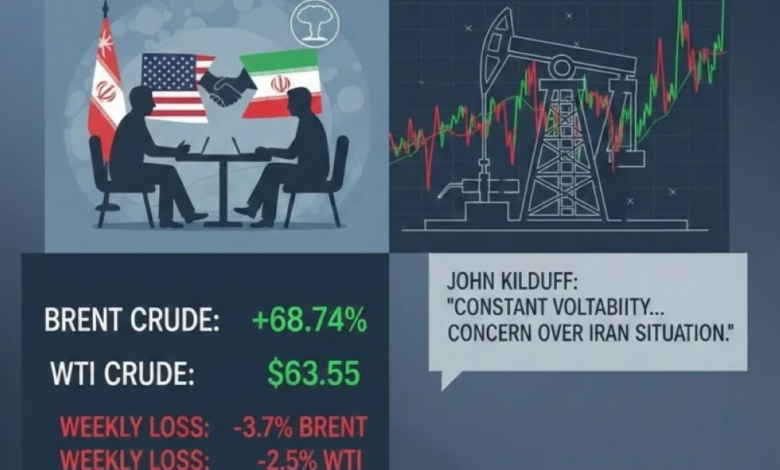

Oil prices post their first weekly loss in 2026 amid geopolitical tensions

Global oil prices showed a notable divergence in their performance at the end of the week's trading, with prices rising at the daily settlement, but suffering their first weekly loss since the beginning of 2026. This weekly decline comes amid a state of uncertainty that prevails among investors and energy markets, driven by the course of diplomatic talks between the United States and Iran.

Market performance and benchmark figures

Looking at the detailed trading figures, Brent crude futures rose 50 cents, or 0.74%, to settle at $68.05 a barrel. Despite this daily gain, the global benchmark ended the week down 3.7%. Meanwhile, U.S. West Texas Intermediate crude rose 26 cents (0.41%) to $63.55 a barrel, also posting a weekly loss of 2.5%.

The geopolitical context and the importance of the event

These price movements are particularly significant given the complex geopolitical landscape of the Middle East. Oil prices have always been highly sensitive to any tensions involving Iran, due to its strategic location overlooking the Strait of Hormuz, a vital artery for global energy flows. Historically, fears of supply disruptions or military action have added a "risk premium" to crude prices, while signs of diplomatic détente have typically calmed markets and lowered prices, which explains the current volatility.

Details of the conversations and their direct impact

This week, markets focused on the Omani-mediated negotiations between representatives of Tehran and Washington. These talks aimed primarily to contain tensions and avert any military escalation that could destabilize the region. Iranian state television reported the conclusion of the current round of talks, with Foreign Minister Abbas Araqchi stating that the negotiating teams would return to their respective capitals for further consultations, while emphasizing that the talks would resume later. This temporary pause without a decisive outcome kept markets on edge.

Expert opinions and future predictions

Commenting on these developments, John Kilduff, a partner at Again Capital, pointed to the current volatile nature of the market, saying, “We are seeing constant fluctuations regarding the situation in Iran. The situation improves one day, or even an hour, and then worsens the next. There is concern about the status quo with respect to Iran.” Economic analysts indicate that continued price volatility could have repercussions for the global economy, as energy prices directly impact inflation rates and industrial production costs worldwide, making the outcome of these negotiations a closely watched topic by economists and policymakers around the globe.