Zatka: Withholding tax forms due date for December 2025

The Zakat, Tax and Customs Authority (ZATCA) has called on all establishments subject to withholding tax in the Kingdom of Saudi Arabia to expedite the submission of their withholding tax forms for December 2025. The Authority clarified that the deadline for accepting these forms is January 11, 2026, emphasizing the importance of adhering to the specified timeline to ensure the smooth operation of financial and regulatory processes.

Details of the deadline and financial penalties

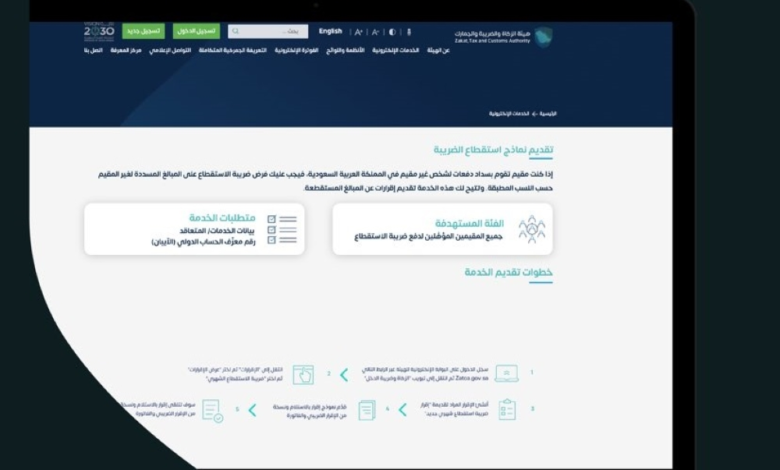

In its commitment to enhancing tax compliance, the Saudi Central Tax Authority (SATCA) has urged relevant establishments to utilize its advanced electronic services and submit forms through its official website (zatca.gov.sa). This reminder aims to help taxpayers avoid late payment penalties stipulated by regulations, where a penalty of 1% of the unpaid tax is imposed for every thirty days of delay, starting from the legally due date. This measure aims to ensure tax fairness and regulate the state's financial flows.

The concept of withholding tax and its legal framework

Withholding tax is a cornerstone of the Saudi tax system, levied on all payments made by a source within the Kingdom to non-resident entities that do not have a permanent establishment in the country. This measure is based on the rates and percentages specified in Article 68 of the Income Tax Law, as well as Article 63 of its Implementing Regulations. This tax covers a wide range of services and payments, such as royalties, administrative fees, rent, airline tickets, shipping costs, and other services provided by non-residents.

Economic context and digital transformation

This announcement comes within the context of the Kingdom's comprehensive digital transformation under Vision 2030, where the Zakat, Tax and Customs Authority has successfully automated most of its operations to streamline procedures for the business sector. The commitment to filing tax returns on time not only reflects an establishment's compliance with regulations but also contributes to enhancing financial transparency and the attractiveness of the Kingdom's investment environment. Furthermore, these tax revenues play a pivotal role in supporting non-oil revenues, thereby strengthening the stability of the national economy and enabling the government to efficiently finance development projects and public services.

Communication and technical support channels

Keen to facilitate taxpayer compliance, Zakat, Tax and Customs Authority (ZATCA) invites businesses seeking further clarification on form submission procedures or withholding tax details to contact them through their various channels. Businesses can call the unified call center number (19993), which operates 24/7, or contact them via the "Ask Zakat, Tax and Customs" account on the X platform (@Zatca_Care), or by email (info@zatca.gov.sa), in addition to the live chat service available on the Authority's website.