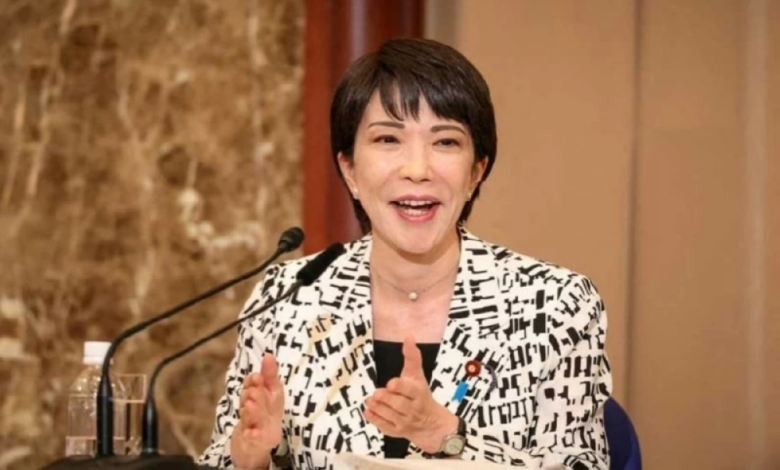

Takaichi: The weaker yen supports exports and the Japanese economy

Sanae Takaichi recently stated that the recent decline in the value of the Japanese yen presents a golden opportunity to boost exports and increase the financial returns of the government's foreign exchange fund. Her remarks highlighted the positive aspects of the weaker currency at a time of growing global and domestic concerns about the stability of exchange markets.

An economic vision to enhance competitiveness

In a speech delivered at a public gathering in Kawasaki, Takaichi reviewed the volatile history of the Japanese currency and the mechanisms employed to address the yen's depreciation through pre-established strategic measures. She explained, "The management of the Special Account for Foreign Exchange is working very well," noting that the currency's depreciation leads, from an accounting perspective, to an inflation of the value of Japan's foreign assets when valued in yen, thus providing the government with a fiscal buffer.

This stance comes in a broader economic context, where major Japanese companies, particularly in the automotive and technology sectors, benefit from the weak yen, which makes their products more competitive and cheaper in global markets compared to their counterparts, thus boosting the profits of companies listed on the Nikkei index.

Historical comparison: A lesson from the 2009-2012 period

Takaichi invoked the historical memory of the Japanese economy, pointing to the period when the yen was exceptionally strong during the Democratic Party of Japan's rule (2009-2012). During that time, the Japanese economy suffered from what is known as "industrial offloading," as many factories were forced to relocate their operations overseas due to the high cost of production and exports from Japan.

She pointed out that it is not definitively clear whether a strong or weak currency is the absolute best option, as each case has its own economic circumstances, but current policies tend to take advantage of weakness to support industrial growth.

Challenges of inflation and cost of living

Despite the export benefits, Takaichi did not extensively address concerns about fueling domestic inflation in her speech. It is a well-established economic principle that a weaker yen directly increases the import bill. Japan is a resource-poor country, relying almost entirely on imports for its energy needs (oil and gas) and a significant portion of its food.

The weak currency leads to higher prices for these basic commodities for the Japanese consumer, creating inflationary pressures that may affect the purchasing power of households, which puts policymakers in front of a difficult equation to balance supporting exports and controlling the cost of living.