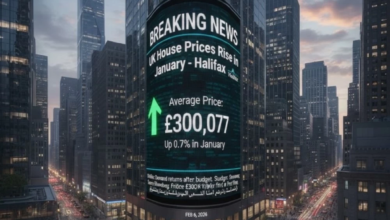

British house prices hit a new record high in January

The UK property market has seen a remarkable recovery at the start of this year, with recent data from the Halifax mortgage lender revealing that house prices in Britain rose during January to unprecedented record levels, a strong indication of a return of confidence for both buyers and investors.

According to a report published by Bloomberg, the average house price in Britain rose by 0.7% last month, reaching a new record high of £300,077 (approximately $407,000). This increase offsets the decline seen in the previous month, when prices fell by 0.6%, indicating the market's rapid recovery and resilience in the face of economic challenges.

Impact of the government budget and the return of stability

Economic analysts attribute this positive shift in price trends to the stability that followed the Labour government's approval of the budget. Clear government budgets are crucial in reassuring financial markets and borrowers, as stable fiscal policies provide clarity regarding future interest rates and taxes, encouraging households and individuals to make home purchase decisions that may have been postponed during previous periods of uncertainty.

Historical context and market challenges

This rise comes after two consecutive months of declining average prices and represents the fastest pace of increase since November 2024. Historically, the UK property market has been highly resilient, but it faced significant pressure in 2025 due to global and domestic economic volatility. Breaking the £300,000 average price barrier is a pivotal event, reflecting the persistent gap between supply and demand. The supply of residential units remains insufficient to meet growing demand, a key driver of long-term price increases.

Economic importance and future prospects

This recovery has broad economic implications. Domestically, rising property values boost household wealth and consumer spending, though they present additional challenges for first-time buyers. Internationally, the renewed momentum in the UK property market reaffirms London and other major cities as safe havens for foreign property investment. These figures clearly indicate that the market has moved beyond the slowdown of 2015 and is entering a new phase of growth supported by government policies and a resurgence in purchasing power.